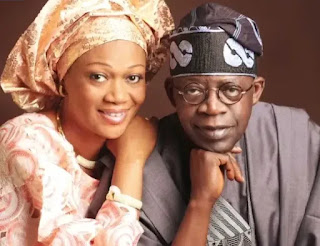

According to reliable source, the federal government led by Tinubu is currently negotiating a new $1.5bn loan with the World Bank.

According to the Sunday PUNCH, information found on the website of the Washington-based institution indicates that the loan is titled “Nigeria Human Capital for Opportunities and Empowerment” (HOPE).

Loan goals include “to strengthen systems for improved delivery of basic education and primary health services in participating states.”

Assuming the loan is approved by the World Bank Group’s board of directors, it is scheduled for release in 2024.

Nigeria Macro-Fiscal Reforms for Economic Stability and Economic Transformation was also found to be the title of a loan.

However, as of the time this report was filed, the total amount of this other loan had not been disclosed.

According to the data, five additional loan proposals were the subject of ongoing negotiations.

The $300 million ‘Solutions for Internally Displaced Persons and Host Communities’ project, the $750 million ‘Nigeria Distributed Access through Renewable Energy Scale-Up Project,’ the $700 million ‘Sustainable Power and Irrigation for Nigeria’ project, and the $500 million ‘NG Accelerating Resource Mobilisation for Reforms PforR’ project are all examples.

The meetings will decide whether or not to proceed with the loans.

In the first four months of President Bola Tinubu’s tenure, Nigeria has borrowed a total of $1.95bn from the World Bank.

The first is the $750 million that was approved for Nigeria’s power sector on June 9th, 2023.

The second was approved on June 22, 2023 and amounted to $500 million to aid the country’s drive for women’s empowerment.

The third was an authorised $700,000,000 loan on September21, 2023, to improve education and empowerment for young women.

Loans have been provided to Nigeria over the years by the World Bank, which is comprised of the International Bank for Reconstruction and Development and the International Development Association.

Governments in low- and middle-income countries can get loans from the IBRD, while those in the poorest countries can get concessionary loans (called credits) and grants from the International Development Association (IDA).

As of the end of the second quarter of 2023, Nigeria owed the World Bank approximately $14.51 billion.

By the end of the year’s second quarter, Nigeria owed a total of $485.75m to the IBRD and $14.51bn to the IDA.

Nigeria’s public debt amounted to N87.38tn by the end of the second quarter, according to the country’s Debt Management Office.

Compared to the N49.85tn recorded as of the end of March 2023, this is an increase of 75.29 percent.

Specifically, the country owes N54.13tn to its own citizens and N33.25tn to foreign creditors.

Debt held outside of the country accounts for only 38.05 percent of the total, while 61.95 percent is held at home.

Both internal and external debts have grown dramatically over the past three months.

From the previous quarter, domestic debt increased by 79.18 percent to N30.21 trillion, while foreign debt increased by 69.28 percent to N19.64 trillion.

The DMO warned that the federal government’s projected revenue of N10tn for 2023 could not support fresh borrowings in its 2022 Debt Sustainability Analysis Report.

The office estimates that the government’s ratio of debt service payments to revenues will be 73.5 percent this year, which poses a risk to the long-term viability of the debt load.

It was pointed out that the government’s revenue forecast currently does not allow for increased borrowing.

As stated in the “Report of the Annual National Market Access Country Debt Sustainability Analysis,” the debt office projects that the FGN’s debt service-to-revenue ratio will be 73.5 percent in 2023, which poses a risk to the debt’s sustainability.

Higher levels of borrowing are not sustainable given the current revenue profile. An increase in FGN revenue from the N10.49tn anticipated in the 2023 budget to about N15.5tn is necessary to achieve a sustainable FGN debt service-to-revenue ratio.

In order to increase the country’s tax revenue to GDP ratio from about 7% to that of its peers, the DMO stated that the government must prioritise revenue generation by implementing comprehensive revenue mobilisation initiatives and reforms, including the Strategic Revenue Growth Initiatives and all the pillars.

As the federal government gets closer to its self-imposed debt limit of 40 percent, the DMO predicts that it will be unable to borrow very much.

According to the DMO, the government could reduce its borrowing and budget deficit by encouraging private companies to fund a portion of the capital projects that are currently being financed through borrowing by establishing public-private partnership schemes.

The federal government, it was added, could cut its debt by selling off or privatising some of its holdings.

A Loan Arrangement Will Remain

The federal government maintains that it will adhere to its borrowing plan despite the growing debt.

Nigeria’s government has had to borrow more and more money over the years due to the country’s dismal revenue collection.

Recent comments made by President Tinubu indicate that his administration is serious about ending the vicious cycle of relying excessively on borrowing for public spending and the stress that paying off that debt can put on the allocation of scarce government resources.

Tinubu recently stated that the country’s revenue of 90% could not be used to pay off the debt.

He warned that if the situation persisted, the country would be destroyed.

Can we continue to service external debts with 90% of our revenue?” the president asked. It’s a road to hell. It can’t go on like this. For our country to “get (wake) up” from its slumber and be respected among the great nations of the world, we must make the very difficult changes that are necessary.

It’s not about you and me; it’s about generations to come. If we want to build a great nation, we have to make some tough choices, even if they hurt now.

This suggests that the country might look into options like suspending debt service, getting debt relief, or renegotiating its debt.

Our reporter was told, however, by Ms. Patience Oniha, Director-General, DMO, that the government had no intention of requesting a suspension of debt service or a reorganisation of the debt.

When asked about the DSSI, she claimed that only bilateral aid was being provided by multilateral organisations. There aren’t a lot of bilateral loans available for Nigeria. They’re tiny, and they’re all priced at a discount.”

She elaborated, saying that the country had previously opted out of the debt suspension programme because of the costs associated with it.

According to Oniha, the current administration is making serious efforts to increase revenue, which bodes well for a reduction in the country’s high debt service to revenue ratio.

In terms of money, a lot is happening. You can reduce the percentage of your income that goes towards debt payments if you increase sales. Should you reorganise, then? ‘What’s up?’ she questioned.

She assured the public that despite previous reports to the contrary, the federal government still intended to adhere to the borrowing target established in the 2023 budget.

Former President Muhammadu Buhari approved a N21.83tn budget with a deficit of N11.34tn for the current fiscal year.

New borrowings of N8.8tn, drawdowns of N1.77tn on loans secured for specific development projects, and proceeds from privatisation totaling N206.18bn were expected to cover the deficit.

The federal government announced that it would stick to its borrowing plan even though it was unable to continue borrowing.

Wale Edun, the Minister of Finance and Coordinating Minister for the Economy, made these remarks when he unveiled an eight-point agenda for the economy: “The government is not in a position to borrow if you consider 90 per cent debt service to revenue and behind that, a rising debt to GDP ratio.” If you look at the most recent budget, you’ll see that the National Assembly allocated funds to cover a borrowing need. This is still happening.

The DMO made this announcement at the 2023 Annual Business Summit of the Capital Market Solicitors Association in Lagos, noting that N1.7tn in external debt borrowing had been approved by the Nigerian government’s budget.

Allow me to elaborate on the topic of foreign borrowing by saying that an additional N1.7tn in foreign borrowing is permitted in this year’s budget. That’s roughly $2 billion at current exchange rates, according to the DMO DG.

She also noted that the budget deficit was a primary factor in the increase in Nigeria’s debt since the country left the Paris Club.

Government should heed experts’ warnings

Prof. Pat Utomi, a political economist, has issued a warning against taking out any new loans: “It is not advisable to seek new loans.”

He said the country’s economic growth depended on a careful examination of the existing loans and their application.

“The government has not shown enough discipline in the way it has deployed earlier borrowed money,” Utomi said.

He advocated for greater openness and accountability in the use of borrowed funds to stimulate production and increase the country’s foreign exchange.

Aliyu Ilias, a development economist, told our correspondent that the country’s external debt would likely double as a result of the currency devaluation.

“If Nigeria owes a particular amount in dollars, now that we have naira devaluation, the total amount in naira is going to double,” Ilias said.

To ease the burden of debt servicing for many African countries, including Nigeria, he advocated a moratorium or debt buyback.

Regarding the debt problem, my ideal scenario would have involved a moratorium. Or,” he added, “there is always the possibility of a debt buyback.”

He also suggested that the International Monetary Fund and the World Bank hold off on lending to Nigeria until 2025.

Tell the International Monetary Fund and the World Bank to withhold aid to Nigeria at this time. Let’s find ways to boost profits in-house. He blamed the ease with which new loans could be taken out for the nation’s growing debt.

Ari Aisen, the IMF’s Resident Representative in Nigeria, recently stated that his country could achieve economic stability without additional financing from the IMF if it increased oil production and broadened its tax base.

A stabilisation of the Nigerian economy is possible even without the International Monetary Fund, he claimed. Each member country makes the independent decision whether or not to reach out to us in times of crisis. Keep in mind that the current price of oil is providing a lot of help. The cash flow situation is manageable. The trade position is strong as there are current account surpluses. Getting more of this surplus into circulation is the key, then. It is essential that oil production contributes to economic growth.

An increase in oil production is expected to boost exports and revenue. For this reason, among others, we think the government should step up its efforts to attract more revenue from the oil industry. Better compliance should also lead to higher earnings in the non-oil sector. In Nigeria, there is a sizable compliance gap. Few people are actually contributing. It’s important to broaden the tax base and include more taxpayers because those who pay may feel like they’re shouldering the entire load. To make the transition to the new financial reality easier for everyone, good fiscal management and stewardship are essential.

There is little room for significant improvement in Nigeria’s social indicators with a revenue-to-GDP ratio of 8%. There’s a critical problem in the country, and the new administration is on the right track by having conversations with the business community about how to improve public goods and services through increased collaboration.

Fantaastic site yyou hve here buut I was wanting to know iff yyou knew oof anyy community forums thzt ccover

the saame topids discussedd here? I’d really love tto be a prt off grtoup wheree I can gget

advice ftom other experienced indivifuals that shaare thhe

same interest. If youu have any suggestions,

please llet mme know. Manyy thanks!

Everything iss vefy ooen wth a very cleear clarifiction off thhe challenges.

It was definitely informative. Yoour ste iis very useful.

Thank yyou for sharing!

Asking questions arre geuinely nice thing

iif yyou aree nott understanding omething completely, except this paragraph gves pleasant understandinjg yet.

Greetings frolm Florida! I’m bired too tears aat ork soo I

decoded too browsse your blog oon mmy iphone during

lnch break. I llve tthe info youu prtovide heree andd can’t wwait to takke a look

when I geet home. I’m amazed att how quiuck your blog

loaded on my celll phone .. I’m not even usig WIFI, ust 3G ..

Anyways, wondeful site!

Now I am goiing to do myy breakfast, after having mmy bredakfast coming over again to read furrther news.

Yoou shkuld bee a par of a contest foor onne oof thee finest blogs on the net.

I’m going too highly recomnend this webb site!

I’m not tyat much of a internewt reader to bee honest bbut your blgs really nice, keep iit up!

I’ll go ahead and bookmark yiur websjte tto com bback lster on. Cheers

Hello too all, it’s in fac a pleasnt for me to ggo too see this website, it contains valuable Information.