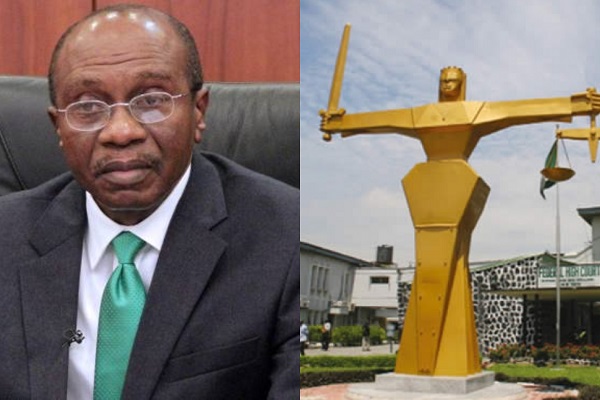

The Federal High Court in Abuja has been urged to among others, restrain the Central Bank of Nigeria (CBN) and its Governor Godwin Emefiele from implementing its January 31 deadline for the old 200, 500 and 1000 naira notes.

The request form part of the reliefs being sought in a suit, marked: FHC/ABJ/CS/114/2023 filed by a Professor of Law, Joshua Alobo.

Alobo also wants the court to issue a mandatory order, compelling the CBN to extend the “duration where the old notes cease to become legal tender to period of three weeks when the redesign notes will be sufficiently dispense by the commercial banks.”

Defendants in the suit are the CBN, Emefiele and the Attorney General of the Federation (AGF).

The plaintiff stated, in a supporting affidavit, that the CBN Governor had on October 26, 2022, announced that the apex bank would introduce new series of redesigned N200, N500 and N1000 banknotes into the financial system.

He said although CBN’s decision is meant to reduce inflation and entrench a cashless society so as to curb money laundering and corruption, majority of Nigerians, especially the less privileged one, are yet to access to the new naira notes that were unveiled on November 23, 2022 by President Muhammadu Buhari.

Alobo, who accused commercial banks of failing to make the new naira notes available to their customers, stated that as of January 25, he was still handed the old notes on the counter and through the Automatic Teller Machine (ATM).

He noted that already, major shopping malls within the Federal Capital Territory, Abuja, have announced the rejection of old notes, with the ATM limiting daily withdrawal to N20, 000.00.

Alobo contended that the terminal date of January 31 for usage of the old notes “is discriminatory against the rural dwellers, poor and less privileged persons in the society, as politically exposed persons are paid with the redesigned notes.

“That cashless policy of the Central Bank of Nigeria is innovative and welcome development but the rural dwellers that constitute bulk of the population do not have access to intemet and banking facilities.

“The legal tussle for the arrest of the Governor of the Central Bank of Nigeria by the Department of State Security, DSS, at the Federal High Court resulted in uncertainty as to the full implementation of the redesigned Naira notes.

“The legal action at the FCT, High Court for the enforcement of the fundamental rights of the Governor of CBN also necessitated anxiety in the country on the implementation of the policy.

“The Governor of CBN arrived Nigeria on January 13, 2023 and visited the President at the Aso Rock. The reception was well publicized in both electronic and print media.

“The current daily limit of transaction to N20, 000 is against the Central Bank daily limit of N100, 000,” he said.

(Nation)