The 36 state governments and the Federal Capital Territory have proposed to spend over N11.5trn in the 2023 financial year, an analysis by the Daily Trust has shown. The breakdown indicated that N6.482trn will be spent on capital projects while N4.989trn is for recurrent expenditure.

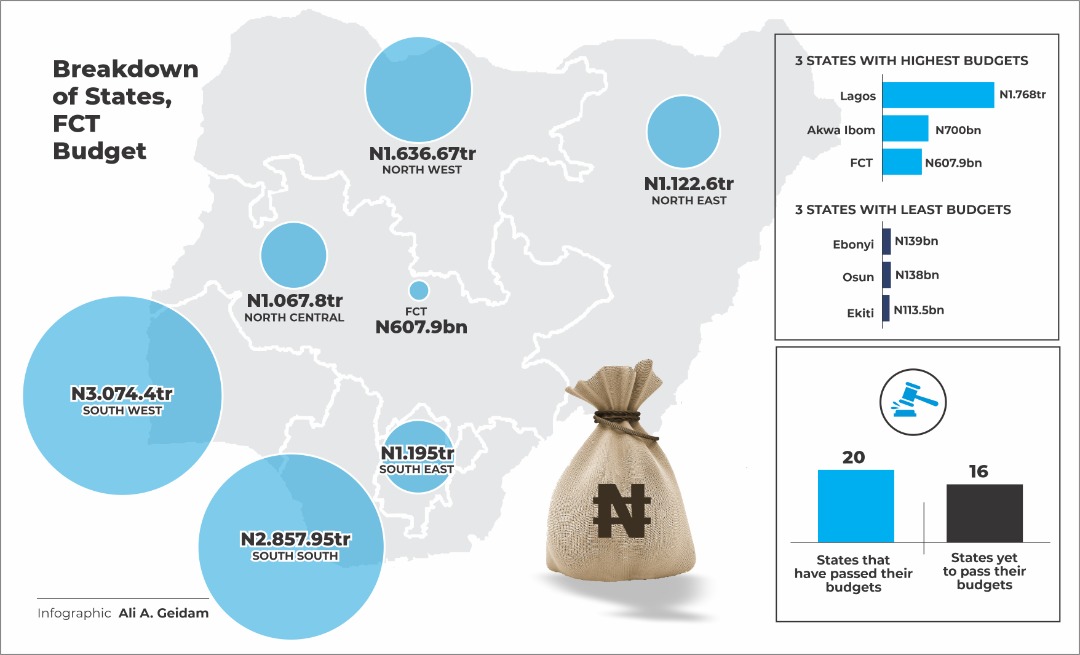

Daily Trust reports that 20 states have already passed their budgets while the remaining 16 are yet to.

Those that passed their appropriations include; Lagos, Ogun, Akwa Ibom, Benue, Bauchi, Taraba, Delta, Katsina, Adamawa, Kaduna, Gombe, Osun, Ondo, Kogi, Yobe, Anambra, Kano, Jigawa and Nasarawa. The states have passed their 2023 budget into law as such money to be spent might increase.

But experts who spoke to Daily Trust described state budgets as yearly rituals because significant parts of the projections were hardly actualised.

In the budgets they presented, Daily Trust reports that only a few of the states explained how they would generate the monies to fund them.

Besides relying on federal allocations and their internally generated revenue to fund their projects, many of them rely on loans (internal and external) to finance their activities.

And in the event they are unable to get such loans, the projections suffer.

At present, many of the states are already heavily indebted even as experts have called for caution on the grounds that being election year, governors, especially those rounding off their tenures must not procure loans for political purposes only to leave the liability for those taking over from them.

Umar Mohammed, a public expenditure expert, said 2023 is a defining moment and urged governors to do the right thing in terms of income generation and spending.

“It is a tempting period, especially for those serving out their tenures. The budget will just be midway by the time they would hand over. Therefore, they should be mindful of the conceptualisation of their projects; they must not undertake while elephant projects.

“Banks and other financial institutions must also be mindful of how they give loans to states because some of these people would divert the funds for campaigns,” he said.

What the states are working on

Analysis showed that Lagos has the highest budget with N1.768trn. It is followed by Akwa Ibom State, N700bn and the FCT with N607.9bn.

On the other hand, the state with the least budget allocation is Ekiti with N113.5bn. It is followed by Ebonyi State with a proposal of N139bn and Osun with N138bn.

Analysis by region showed that the South West has the highest budget with N3.074.4trn. It is followed by the South South with N2.857.95trn, North West N1.636.67trn, South East N1.195trn, North East N1.122.6trn and North Central N1.067.8trn.

Brief details of states

Lagos, whose budget can encompass the budgets of many states, plans to spend N748bn on recurrent expenditure and N1trn on capital expenditure.

The sectoral allocations also showed that N3.2 billion was approved as the new overhead cost of the office of civic engagement for drug abuse advocacy.

N802.9bn was approved as the new capital expenditure of the Ministry of Economic Planning and Budget, while N1,200bn was approved as the new overhead cost (Social Intervention and Humanitarian Programme) in the Ministry of Economic Planning and Budget.

For Akwa Ibom, it budgeted N700bn, out of which N344bn will be spent on recurrent expenditure and N356bn on capital expenditure.

It said the budget would be funded through recurrent revenue of N390.8bn which includes internal revenue of N47.8bn, N51bn statutory revenue, N200bn derivation revenue and N10bn from Excess Crude among others.

For FCT’s N607.9bn budget, N214.6bn will be spent on recurrent expenditure while N393bn will be on capital expenditure.

Delta State has approved N571.6bn of which N235.5bn is for recurrent expenditure and N336.1bn as capital expenditure.

The governor of the state, Ifeanyi Okowa, said it would be funded with Internally Generated Revenue (IGR), N95 billion; statutory allocation, N357.9bn; and other capital receipts of N80.3bn.

Rivers State has proposed to spend N550.6bn from which N175.2bn will be on recurrent expenditure and N350.9bn on capital expenditure.

According to the document, the state will spend N114.2bn on infrastructure; N36.9bn on education and N31.5 on health among others.

Imo State is planning to spend N474.4bn with N150.4bn going into recurrent and N373.5bn going to capital expenditure. It said the budget would be funded through Internally Generated Revenue, N79.8bn; statutory allocation of N35bn, and Value Added Tax of N15.7bn among others.

Ogun State has proposed N472.2bn, with N202.6bn for recurrent expenditure and N269.6bn for capital expenditure. It plans to give the Ministry of Works and Infrastructure the largest share of N129.3bn, representing 27 per cent of the total budget.

Bayelsa State is to spend N385.2bn in the 2023 fiscal year. It earmarks N158.8bn for recurrent expenditure and N167bn for capital expenditure. Also, public and debt service are expected to gulp N33.7 billion and contributory pension N4.7 billion.

In the breakdown of funds allocated to ministries in the state, works and infrastructure was allocated N77.9bn; education N40.4bn, and agriculture N14.1bn.

Kaduna State has approved spending N376.45bn out of which N127bn will be on recurrent expenditure and N248bn on capital expenditure.

The governor of the state, Nasir El-Rufai, said the allocations are 29 per cent of the budget to the education sector and 16.05 per cent to health as part of the government’s commitment to human capital development.

For Cross River, it will spend N330bn this year, with N130bn for recurrent expenditure and N200bn capital expenditure.

Edo plans to spend N320.35bn from which N192bn will go to capital expenditure and N127.5bn for recurrent expenditure. The state’s projected revenue for 2023 is N300bn, consisting of N144.26bn statutory allocation, made up of Value Added Tax (VAT) of N41.2bn; capital receipts of N46.1bn; IGR N60.4bn and N4bn from grants, among others.

Oyo State said it would spend N310bn. From the amount, recurrent expenditure will get N155.6bn while N154.3bn will go to capital expenditure.

Katsina State plans to spend N289.6bn with N105.5bn on recurrent expenditure and N184.05bn on capital expenditure.

Ondo State has earmarked N272.7bn for 2023 with N129.2bn on recurrent expenditure and N143.5 on capital expenditure.

Anambra State is to spend N258bn from which N95bn is for recurrent and N164bn capital expenditure.

For Kano, N268bn is budgeted from which N100bn will go into recurrent expenditure and N168bn capital expenditure.

Niger State budgeted N243bn with N91bn for recurrent expenditure and N152bn for capital expenditure.

Borno State is to spend N234.8bn out of which N90.6bn is for recurrent while N144.1bn will go to capital expenditure.

Bauchi State plans to spend N202bn in 2023 with N87bn for recurrent expenditure and N114bn for capital expenditure.

Sokoto State has proposed N198.5bn budget for the year with N83.8bn for recurrent expenditure and N111.4bn for capital expenditure.

N189bn is to be spent by Kwara State in 2023 with N94bn earmarked for recurrent expenditure and N95bn for capital expenditure.

Zamfara State said it will spend N188.8bn in 2023 with N102.5bn going to infrastructure and N86.3bn to capital expenditure.

Benue State announced a budget of N179.7bn and plans to spend N106.1 on recurrent expenditure while N73.5bn will go into capital expenditure.

For Jigawa State, N178.5bn will be spent with N81.9bn going to recurrent expenditure and N89.4bn capital expenditure.

Adamawa State is set to spend N175bn with N105bn going to recurrent expenditure and N70bn capital expenditure.

Gombe State budgeted N176bn for 2023 with N71.8bn to be spent on recurrent expenditure while N101.8bn will be for capital expenditure.

In Taraba State, a budget of N173.2bn has been approved with N74bn to be spent on recurrent expenditure while N98.6bn is for capital expenditure.

Kogi State budgeted N172bn earmarking N101.3bn for recurrent expenditure and N70.7bn for capital expenditure.

Kebbi State says it is spending N166.9bn in 2023 out of which N60.4bn will be on recurrent expenditure and N106.5bn capital expenditure.

The proposal for Enugu State is N166.6bn with N81bn to go to recurrent expenditure and N84bn for capital expenditure.

Yobe State proposes to spend N163bn with N87.8bn for recurrent expenditure and N75.1bn for capital expenditure.

Abia State plans to spend N157bn from which N75bn will go into recurrent expenditure and N82bn is capital expenditure.

Nasarawa State also budgeted N149.3bn for 2023 and allocates N90.5bn to recurrent expenditure and N58.3bn capital expenditure.

Plateau State is to spend N139.3bn and from this, N77.6bn is for recurrent expenditure and N61.7bn for capital expenditure.

The Ebonyi State budget is N139bn for the year with N58.3bn going to recurrent expenditure and N81.03 capital expenditure.

Osun State will spend N138bn, with N99.2bn going to recurrent expenditure and N39.05bn for capital expenditure.

Ekiti State has the least budget for 2023 as it plans to spend N113.5bn with a huge chunk of N80.3bn going into recurrent expenditure while N34.06bn will be spent on capital expenditure.

State budgets are mere rituals – Expert

Speaking on the findings of the analysis, a financial expert and CEO of Cowry Asset Management, Johnson Chukwu, said the challenge with state government budgets is that there is no science in it.

“You have a state budget that is not adhered to but is a mere ritual. It is a difficult thing to use the state budget as a basis for projection for macroeconomic analysis.

“A lot of states do not have fiscal discipline and do not follow through the budget process for anything. We had a state which makes budget of trillions but actual revenue is less than 10 per cent of what was budgeted and gives it high sounding names,” he said.

He added that for states to make a determined approach to the budgeting process, there is the need for the federal government to introduce fiscal federalism.

“Once that is introduced, state governments will be compelled to seek ways to generate revenue to sustain their operations.

“As long as we continue with this sharing formula where a state government will not do anything to grow its revenue but be sure that at the end of every month, the governor will have enough which he does not know how it was generated, that for me, does not build responsibility on the path of building these sub-nationals,” he stated.

He maintained that this has contributed to why Nigeria is underdeveloped, as there is no system that would develop by building on handouts “which is the fiscal system we have.”

“The federating states in other jurisdictions actually contribute to the centre and live on their income. Unless they have difficult challenges when the centre will go in to support them.

“But it is not a norm for you to wait for Federation Account Allocation Committee (FAAC) meeting to collect money and use it however you like,” he said.

He, therefore, said there is a need to change the extant law and push for fiscal federalism where state governments generate their revenue; spend from what they generate and contribute to the centre.

(Daily Trust)