Small and Medium Enterprises (SMEs) in the Federal Capital Territory (FCT) are finding it difficult to thrive because of multiple taxes and other restrictions.

After successfully struggling to stay afloat due to economic challenges brought by the lockdown occasioned by COVID-19, small businesses still grapple with the excesses of some officials who are all out to generate revenue for governments at different levels.

The business owners include caterers, restaurateurs, farmers, tailors, and mechanics among others.

Apart from forcing them to pay different taxes, the revenue collectors also exploit them by closing their shops without following due process.

Some business owners interviewed described the situation as “abnormal,” saying the inhumane treatment by some government officials while serving demand notices and collecting taxes is discouraging.

To stay afloat, many of them that are trying to grow their businesses devise means of reducing pressure, including operating without signposts.

Others register their business premises and vehicles as privately owned, all to survive.

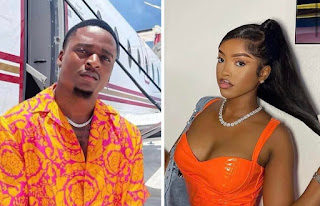

Despite these methods, the Chief Executive Officer of 99J Bakery, Utako, Farida Abubakar, said there was time she considered closing up her business due to the “rudeness, harassment and threat” by some government officials.

“They give no space for a benefit of the doubt; maybe you have a problem so you could not meet up. With my encounter with them, they are very rude. It got to a point that I had to involve my dad last year,” she said.

According to Farida, “We have to pay signage if we put our signpost outside. And the regulator enforces it by coming with people like thugs. If not for a few policemen among them you might feel being robbed.

“They are merciless. They can do anything they want. Sometimes they lock people inside the building and leave. So to survive, we have resorted to operating without a signpost.”

Farida, who has been at the helms of affairs at 99J Bakery for about four years, with 10 employees, said, “We chose the wrong time to venture into entrepreneurship.”

She said some bakeries had closed due to the harsh economic realities in the country, heightened by excesses of some government agencies.

“We are facing hardship because of the economy, coronavirus and the issue of so many taxes from the government. The raw materials have skyrocketed and the government does not subsidise the cost of flour. I closed the bakery for one month due to COVID-19. I normally did about eight bags in a day, but now we barely sell five bags.

“The government is not helping. I was expecting that entrepreneurs would get waivers for them to get their feet on the ground,” she said, adding that some government officials rather issue demand notices, with a threat to pay N250,000 as fine should one default.

“The notices come annually, and you have to pay, instead of spreading it across the months. They give you one year and expect you to pay for that one year. Where do they expect us to get the money? The health inspectors come every six months. If you don’t do that, the fine is N250,000. And they may seal up your shop if you default. These are the challenges we are facing,” she said.

The Managing Director of Orkin Nigeria Limited, Terungwa Abari, said due to high and several taxes paid to the government, the company removed its signpost at their office in Maitama.

“But it affects our business. It is a big plus to your business when people know your address and what you are doing. But you have to hide who you are because the taxes are just too much, it affects us,” he said.

Abari, who is also the president of the Environmental Preservation, Development and Restoration International Organisation (EPDRIO) in Abuja, said the association had over 260 member companies that are SMEs, saying all of them are struggling to survive because of multiple taxation and registration.

He said members must register with four government agencies including the Abuja Environmental Protection Board (AEPB), Abuja Municipal Area Council (AMAC), Environmental Health Officers Registration Council of Nigeria (EHORECON), and the Public Health Department of the Federal Capital Territory Administration (FCTA).

“All these registrations are renewable every year. The AMAC charges us N100,000, EHORECON charges N60,000, Public Health charges N50,000, and the AEPB charges N60,000. Then there is the rent, which has been hiked by the addition of the tenement rates, solid and liquid waste disposal, vehicle signage and local government papers, among others.”

Abari said many companies had collapsed this year while several businesses struggle to survive “and all the government does is appoint some consultants who go with magistrates to enforce the law.”

According to him, “Anytime they want, they can write a letter to you and issue you a fine; it is a court. The government has a steady mechanism. Whether you are there or not, the judgement will be given against you. In several cases, they have sealed up the premises of some of our members for not complying with their judgements, which they were not privy to, in the first place.

“When it comes to enforcement, they have a very good mechanism. Many of us are finding it difficult to survive. The government fails to realise that we are the drivers of the economy but their policies don’t favour us. We don’t see serious kind of support; only on television. We don’t get anything apart from paying taxes.”

“Most times, when we go to complain, their standard response is that they are going to look into it and nothing changes,” he said.

“I also contemplated closing shop when I realized I am being cheated and sabotaged through the collection of multiple taxes,” said Dahiru Musa, 37, who operates a laundry shop, a poultry farm and a supermarket in one of the suburbs of Abuja.

“I am a graduate but could not get a job for years,” he said. “My younger brother who has been a businessman for many years encouraged me to start something and he gave me some money. He said I should keep my certificate aside and establish something that I can manage which I did.

“Sadly, the way tax collectors are harassing me is unprecedented, some of them would tell you they are collecting the money on behalf of the federal government and some would say they are collecting another tax on behalf of the area council.

“It is very frustrating…Sometimes the taxes eat into your main capital after paying the people who work for you and settle other bills like electricity and water.

“In some countries, the government helps young people like me through a tax holiday. They will not collect anything from you for years because they want you to grow,” he said.

Eunice James, who has a laundry shop, said she had to remove the signpost to have peace. “But the decision is affecting me because it is the signboard that normally attracts customers. We now resort to advertising our products and services through social media like Instagram and Twitter,” she said.

A fashion designer at Sabondale Plaza, Utako, who pleaded anonymity, said the plaza was sealed some years ago by AMAC officials while enforcing collection of tenement rates. The young entrepreneur said that considering the nature of his job, he lost some customers following the ugly development as he could not deliver on his promises to them.

The Special Adviser to President Muhammadu Buhari on Ease of Doing Business and Secretary of the Presidential Enabling Business Environment Council (PEBEC), Jumoke Oduwole, said it is wrong for officials to lock up shops, staff and customers while enforcing an order. She was responding to the closure of the restaurant at Gwarinpa.

Though the issue of the Gwarinpa restaurant was later resolved when the restaurateur discovered that the action of the government officials was because of a court summon, other business owners said the closing of shops is a recurrent decimal in the FCT.

“It highlighted how far the government could go in the name of enforcement, thereby discouraging small business owners,” a resident, Kikelomo Kayode, said.

Although not an entrepreneur, Kayode said most people in businesses in the FCT are subjected to inhuman treatment by government officials, adding that several altercations between business owners and revenue collectors leave much to be desired.

“If someone is not strong-willed, doing business in Abuja is not the way,” she said.

The Chief Press Secretary to the AMAC chairman, Babangoshi Jibreel, said the council would not frustrate the activities of business owners; rather, it is working to ensure a conducive environment for businesses to thrive.

Jibreel said residents hardly differentiated between AMAC and FCTA officials in terms of revenue collection, adding that the council is working on a policy statement to guide the activities of officials that interface with business owners.

“We are submitting a report to the chairman to enhance a policy statement. The best way is for us to engage in sensitising the people in differentiating these two (AMAC and FCTA officials).

For most of the technical partners we engage, they will have to reorient and educate their staff on ensuring a civil approach. Let them approach people with civility so that they can have an understanding and there will be a conducive environment for business owners,” he said.

On multiple taxations, he said, “The AMAC can come to collect its tax for a particular thing and the FCTA will come, but at the end of the day, the blame goes to the AMAC.”

He said the council could not, and would not frustrate the effort of the SMEs, adding that more room for communication would be opened between business owners and the government.

“We recommended (in the report to be submitted to the council chairman, Abdullahi Adamu Candido) that there should be a quarterly town hall meeting with all these small and medium scale business owners so that we address these issues. We are hoping that the chairman would approve it and we will get across to them. They should be hopeful about a policy statement to ensure a friendlier and conducive environment for businesses,” he said.

Also, while responding to inquiries, the Director of Monitoring and Evaluation, Health and Human Services Secretariat of the FCTA, Dr Abubakar Ahmadu, said they don’t collect taxes from private health establishments.

He explained that what such institutions paid to the FCTA treasury was annual fees, which are applicable in every state of the federation.

“At the point of registration, such private health establishments are made to register; after that, they pay annual levies to the FCTA. So if you know anyone going about collecting taxes from them, you let us know and we will take it up from there,” he said.

On the charges by the Department of Outdoor Advertisement and Signage (DOAS), Ngozi, who is the public relations officer of the agency, said in a text message that she needed clearance from her boss before she would speak.

The Registrar of the Environmental Health Officers Registration Council of Nigeria (EHORECON), Yakubu Mohammed, said pest control practitioners register with the council as a professional body.

On the other registrations, he said, “For you to operate also within the jurisdiction of the AEPB, you need to get a permit.”

On the way out, he said, “We as regulators want to streamline the issue of the permit system because you don’t need to get a permit from the AEBB if you are getting it from AMAC. Constitutionally, it is the responsibility of the local government to give you a permit. As a private organisation, you don’t have the right to issue a certificate at the end of disinfection, it is the responsibility of the local government as enshrined in the constitution,” he said.

An economist, Malam Abba Usman, said it would be difficult for small businesses to survive if the environment is not conducive.

“The President Buhari government through the CBN and other interventions is doing a lot to encourage small businesses and by extension create jobs, but I am afraid the struggle to generate revenue is reversing the gains,” he said.

“The federal government should find a way of asking revenue generating agencies to streamline what they collect. They should also do it with decorum. I expected that those collecting revenues would relax until we truly recover from the shock of the COVID-19,” he said.

Samuel Balle, who teaches finance in of the schools in Abuja, said there was no need to tax small business. “Some of these businesses have less than 10 people in their payroll but they always struggle to pay them. They should be supported,” he said.

In July this year, the federal government announced plans to roll out a N2.3 trillion stimulus package and survival fund for Micro Small and Medium Enterprises (MSMEs) to stay afloat amid the economic challenges imposed by the pandemic.

The Vice President Yemi Osinbajo, who also heads the Economic Sustainability Committee, announced it at the 2020 edition of the Micro MSMEs Awards held virtually in July.

MSMEs that have between 10 to 50 staff are qualified for this fund. The businesses must make their payroll available to the government for verification while applying for the fund. Once qualified, the MSMEs will be eligible to have their staff salary paid directly from the fund for 3 months. (Daily Trust)