A Federal High Court in Lagos has granted an interim order restraining 22 banks from honouring any MasterCard transaction bearing the logo of the National Identity Card Management Commission (NIMC).

Justice Rilwan Aikawa said the order subsists pending the determination of a design infringement suit filed by Chams Plc, and Chams Consortium Ltd against the Singaporean payment and financial technology firm.

The judge made the order on November 9, following Chams Plc’s ex-parte application filed on August 28 through its counsel, Kemi Pinheiro (SAN).

The ex parte injunction also included an Anton Piller order.

An Anton Piller order provides the right to search premises and seize evidence without prior warning. This is intended to prevent the destruction of relevant evidence, particularly in cases of alleged trademark, copyright or patent infringements.

Joined as defendants with MasterCard in the suit marked FHC/L/CS/1440/2019, are its Nigerian subsidiary Mastercard Services Sub-Sahara Ltd, NIMC.

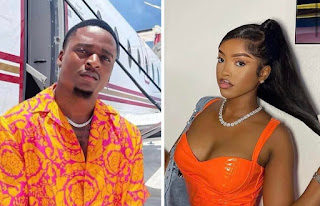

Other defendants are President and Chief Executive, Mastercard International, Ajay Banga; Country Representative of Mastercard in Nigeria, Omokehinde Ojomuyide; a member of staff of Mastercard, Daniel Monehin and 22 commercial banks.

The order states inter alia: “An order of interim injunction restraining the defendants, whether acting by themselves or by their directors, officers, servants, agents, technical managers, or otherwise however from further manufacturing, producing, designing and or printing or authorising the manufacturing, production, designing and or printing of any National Identity Card with MasterCard logo…pending the determination of the motion on notice filed for hearing.”

The judge further directed that the court order and other processes including the writ of summons, statement of claims, witness statement on oath, list of documents, and any other documents be served outside jurisdiction on Mastercard’s office at 152, Beach Road, 35-00, The Gateway East, Singapore.

Chams Plc and CCL, in a 41-paragraph statement of claim prayed the court to compel MasterCard to pay them N114billion as damages.

The sum comprises N84billion as special damages as a result of loss of expected revenue for eight years; N10bn for general damages of allleged fraud perpetrated jointly and severally against the claimants; and N20bn for allegedly inducing the breach and termination of the concessions awarded to the claimants by the NIMC, which occurred as a result of the Mastercards’ alleged fraudulent actions.

Other reliefs include: “An order for the delivery-up, or destruction upon oath of all National Identity Smart Cards produced by the 1st, 2nd, 4th and 6th defendants using the plaintiffs’ concept and design or other articles in the possession, custody, or control of the defendants;

The plaintiffs averred that sometime in 2006, the Federal Government invited them to bid for the Nigeria National Identity Card project.

They said on May 25, 2007, NIMC on behalf of the Federal Government announced the plaintiff (Chams Plc) as the preferred bidder for the concession.

This, the plaintiffs said, was confirmed by a letter from NIMC on the same date.

“The first and second defendants, as a result of their perceived competence in the financial and payment service space, approached the plaintiffs through the 5th and 6th defendants on the authority of the 4th defendant with an offer to provide the payment infrastructure for the card”, the plaintiffs further averred, pointing to several correspondences between both parties.

In another instance, they alleged that MasterCard stole and infringed their intellectual propery in the design of the National Identitiy card.

The case was adjourned till November 25, for hearing of the motion on notice.

508477 792169Interested in start up a online business on line denotes revealing your service also providers not only to humans within your town, nevertheless , to numerous future prospects which are cyberspace on several occasions. pays every day 613537